One of the most confused and misunderstood trading techniques is day trading (also known as short-term trading, intraday trading, or daily income trading). Without question, many believe that day trading bears more risk and volatility than other trading types.

All thanks to how quickly investment positions move within a trading day. Let us confirm this belief by analyzing a few strategic and helpful tips for day trading, for both experts and beginners. Simultaneously, we will discuss how exactly day trading works.

These tips/strategies for day trading is helpful to all traders, regardless of your level of experience, and regardless of asset class (forex, futures, or stocks). It ultimately helps you to develop even more effecting day trading strategies for your portfolios.

Top 10-day Trading Tips For Newbies

Be on the lookout for good entry points

We, at our online trading academy, teach strategies for trading using supply and demand.

Find areas where supply and demand and drastically imbalanced and used them as your point of entry. The financial markets are no different from any other thing in life: if supply is getting almost exhausted and there are still willing buyers, then you can trust the price to move higher.

And on the contrary, if supply is in excess, however, with zero willing buyers, you should expect the price to fall. Here at our online trading academy, we teach our students how to recognize these potential turning points on price charts via the study of historical examples.

Set price targets for your day trading

With a stop loss in place, you can minimize your losses.

Regardless of your level of expertise, you should set price targets for your daily trades before entering the financial markets as a trader. If you are going long on a trade, you should decide in advance an acceptable profit and a stop-loss level in case the trade turns against you. Then, most importantly, ensure you follow your decisions religiously.

This limits potential losses and keeps you from being excessively greedy, especially when an untenable price spike is experienced. However, in a strong market, you can make an exception to this by setting a new profit goal and a new stop-loss level once you hit your initial target.

Choose an excellent risk to reward ratio

As a trader, you must know your risk to reward ratio.

Another important lesson to learn as a beginner stock trader is understanding a proper risk to reward ratio. As a beginner, you should religiously abide by the rule of risking only $1 to potentially earn $3, i.e., a risk to reward ratio of 1:3.

As we have pointed out at our online trading academy and have researched about Pikdo, the utilization of a proper stop loss allows traders to win big and lose small, and even enjoy the potential of coming out ahead regardless of how many losses you have on your traders.

With some higher level of experience, you can upgrade your risk to reward ratio to 1:5 or even higher as you deem fit.

Exercise patience

Sincerely, day trading demands patience. As paradoxical as this may seem, successful day traders do not often trade all day or every day. Most of them have a certain time that they believe is the best time for them to day-trade.

During these times, while in the markets, if they do not catch a wave of any opportunity that meets their criteria, they will rather not trade for that day instead of going against their best judgment out of impatience. So, in essence, ensure that you plan your trades and stay patient enough to trade your plans.

Stay disciplined

As a forex, futures, or stock trader, you must be disciplined.

Discipline is required to record consistent trading outcomes. As a beginner, you need to set and stick to a trading plan. At our online trading academy, students execute live stock trades under the strict supervision of a dedicated instructor.

This is aimed at making our students better at decision making. As a trader, your worst enemy can be impulsive behavior. You can be in a position for too long, all thanks to greed. Fear, on the other hand, can make you exit trades just too soon. The thing is, never have the mindset of getting rich with just one trade.

Execute trades confidently

Don’t be scared to enter a trade. Novice day traders often experience paralysis by analysis, as they become engrossed with watching the trading chart candlesticks and the Level 2 columns on their screen.

This stops them from acting fast in the face of an opportunity; as a disciplined trader, placing a trade order should be an automatic action. If your analysis is wrong, you can trust your stop loss to get you out without significant damage.

Be wise with your budget

Do not trade with money that you need. Again, do not trade with money that you have set aside to achieve a goal.

Successful traders usually have a small bucket of risk capital but a bigger bucket of money to save for either an entirely different long-term goal or for retirement. Basically, big bucket money tends to be more conservatively invested and also in positions with longer durations.

It is not as if it’s forbidden to use this money for day trading occasionally. However, one must ensure that the stock purchase agreement is set as per your budget and the odds are on the high side in your favor before you do so.

Ensure that you balance the capital you invested in each trade

Before trading, determine your position size.

Position size means the amount of capital that you allocate to a trade transaction in the stock market. For example, if a trader plans to invest $100, such a trader can buy ten (10) units of a stock priced at $10 each.

You must never risk excess capital on one trade. Incentivize yourself to set your position size as a percentage of your total budget for day trading. And this percentage is dependent on a trader’s budget, ranges from 2% to 10%.

Exceeding the percentage of position size that you have determined may cause you to miss out on even better market opportunities. Why? Because you have your funds already tied down in one or two trades. Besides, the higher your position size, the higher your risk of losing.

There are other options beyond trading the stock market’ explore them!

Forex and futures are assets that you can explore; they also offer similar leverage.

Although many day traders start with trading stocks, however, that doesn’t infer that day trading is limited to the stock market only. Futures, and forex are assets with similar liquidity and volatility with stocks.

Hence, it is safe to call them ideal assets for day trading. And on days when the stock market seems asleep, one of these other options will suffice as a presenter of appealing opportunities.

Make experience your teacher

Learn trading strategies from experienced and professional traders.

After placing your order, should it go against you, you shouldn’t second-guess or beat yourself for mistakes as a trader. Honestly, all day traders experience losses. So, it is okay when your trade, occasionally, doesn’t go as planned, especially if you are a beginner.

In a situation whereby you experience loss, evaluate such trade to confirm that you followed your trading rules and plans and didn’t make a mistake with your entry and exit timing.

Journal such a trade, learn from any of the mistakes you must have made, and move on to the next trade. This way, you are building on your experience.

Day Trading FAQs

What Is Day/short-term/intraday/ daily income Trading?

In the simplest of terms, day trading is the process of entering and exiting a trade position within a single day. It refers to trade positions that are held for a short time. In essence, as a trader, you open and close your trade on the same day. Sometimes, positions can be held for longer periods as well.

For day trading, you can either go long or short. That is, buying outrightly or borrowing shares then selling at certain prices. Day/intraday traders are looking to take advantage of volatility during the day, hence reducing overnight risks caused by events like bad earnings surprises that might happen after the markets’ closure

What is the level of risk involved in day trading?

Experts at our online trading academy say that because day trading is executed within a day, it is actually safer than riskier.

“One of the best ways to control risk is limiting the length of the trade. The longer you are in a position, the greater the likelihood that price could move against you. By day trading, you eliminate overnight and weekend risk, especially when you trade markets that close, like stocks.” – Bernd Skorupinski, Hedge Fund Manager and Co-Founder of Online Trading Campus

Because day traders do not hold their trading positions over the night, they are safe from the risk of surprise, negative economic news, or earning reports revealed after the closure of markets.

Although there is room for after-hours trading for several securities, it is a thin market, and most likely, it’s position will open at a terribly lower price (gap down) the day after an adverse overnight event.

Additionally, day trading tends to reduce, not increase market volatility. Day traders are on the lookout for their profits in small price movement, whether down or up. The daily trades of this kind of traders offer liquidity, which ensures the smooth running of the market compared to lightly traded markets prone to dramatic price swings.

However, you must know that day trading isn’t a get-rich-overnight scheme. If approached correctly, day trading is a conserving approach of investment used by several institutions and individuals. Using or not using leverage is a choice.

In the 1990s, day trading had a bad reputation when a high influx of beginner traders began to day trade, jumping onto the new online trading platforms without first applying stock trading approaches tested and proven to work.

This set of traders were beclouded with the thought that they can go to work in their pajamas and earn a fortune in trading stocks with very little knowledge and effort. This proved to be wrong.

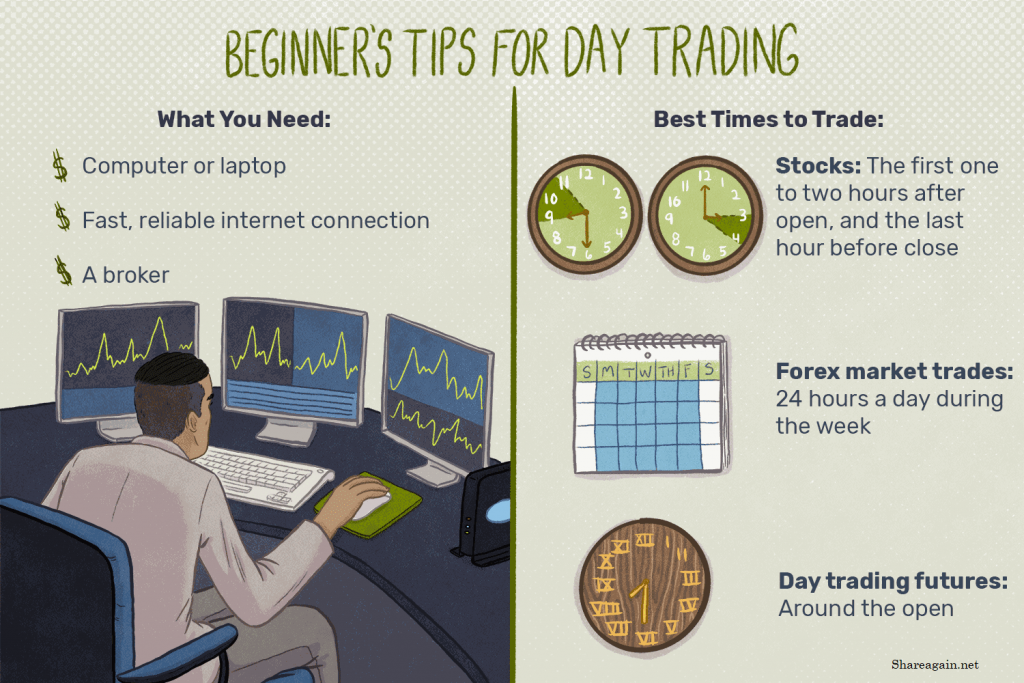

Nonetheless, day trading isn’t as complicated as you may think. First, learn a straightforward, rule-based strategy for anticipating market moves, like those we teach at our online trading academy. To start day trading, what do you need?

You need some services and equipment to be a day trader. While several persons believe that a daily trade setup demands the best equipment and significant capital investment, it is not usually the case. Here’s a list of items commonly needed by day traders:

Technology – Contrary to popular belief, you do not need a truckload of monitors or supercharged computers to trade in the markets as a trader. A laptop PC or shelf desktop computer will do. Regardless, ensure you confirm from your broker the computer requirements to certify you have just enough power to make use of their software.

Internet connection – The importance of speed for timeliness in order processing, especially in a fast-paced market, can never be exaggerated. Most cables and satellite providers offer just enough bandwidth for proper connection to the exchanges.

Typical packages of 100mbps are in abundance. We’ve seen traders even make use of connections with their mobile phones at speeds of 10mbps to 100mbps. This is not recommended, though—connections that mobile devices offer can lead to delayed transactions and unforeseen losses.

Direct Access Trading Brokerage – As a trader, you must be careful at this point. Many brokers online offer their services, routing your orders through market makers who might delay order processing and even incur extra costs.

Direct Access Trading Brokerages route orders to the exchanges faster, without intermediaries who slow the process. These brokers offer better structures for commission and more powerful trading software. Before you sign up with a broker, confirm that you are comfortable with the software and that it’s compatible with your computer.

Trading Platform – Also confirm the user-friendliness of the trading platform: how easy can you carry out trade analysis? How quickly and accurately can you place orders? Do they provide a web-based interface, or you need to download their software?

Both the web and the downloaded version are fine, though. Just that the latter may give more features than the former; confirm if the broker has a mobile version.

Skills – Honestly, education alone isn’t enough to be a consistently successful trader. Although it is necessary to know how the market works, you also need skills to record consistent results.

To build a skill, you need experience and practice. However, wanting to have skill without guidance can be very lengthy and frustrating. Using a mentor’s experience to learn and practice is one great way to sharpen skills and learn proper trading, investing, and risk-minimizing strategies.

Even highly influential persons like Paul Tudor and Warren Buffett had mentors. While Eli Tullis mentored Paul Jones, Benjamin Graham did mentor Warren.

At our online trading academy, our primary day trading strategy depends on patience and an excellent understanding of how to analyze the risks and rewards of any trade.

Also, for the stock (equity) market, Online Trading Campus provides trader education related to CFD, currency trading, and futures. We also have a track of wealth management for individuals who aren’t quite active as traders but still want to be on top of their portfolios.

Typically, here, potential students start with an introductory class – it is free. In this class, these students will learn more about day trading plus other topics on trading too. The introductory class is offered online at our website.

If you want to learn more about professional trading and investing across multiple asset classes such as forex, futures, and stocks, please sign up for free at our online trading academy and get access to a free three-hour introductory course.

Happy trading!